Financial Infrastructure for Retail Cash Flow ✦

Grow retail sales — profitably.

VendorConnect connects sales, operations and finance - so brands know if an order makes money before it ships and recover revenue when things go wrong.

Built for Brands Scaling Into Retail

Consumer Brands

Grow retail without losing margin visibility

As brands expand into distributors and retailers, pricing, promotions, and fees become disconnected across teams. VendorConnect connects orders, invoices, and payments so teams understand true profitability — not months later.

Importers & Distributors

Align commercial agreements with financial outcomes

High order volume and complex retailer requirements create operational friction. VendorConnect centralizes terms, payment behavior, and deduction patterns so teams scale without financial surprises.

Finance Teams

Replace reactive reconciliation with real-time clarity

Stop chasing portals and spreadsheets. VendorConnect explains every variance between expected and actual payments — automatically prioritizing what impacts margin and cash most.

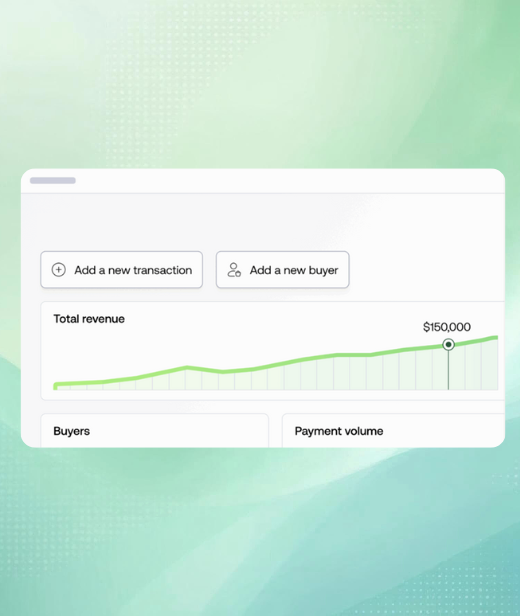

Grow your business, improve your cash flow, and scale your buyer base

Complete Cash Flow Visibility — From Order to Cash Received

VendorConnect connects commercial decisions to financial outcomes — from order acceptance through final payment.

Know if an Order Makes Money Before You Accept It

Sales negotiates deals. Finance validates them later. VendorConnect brings financial clarity upfront. Turn order approval into a financial decision — not a guess.

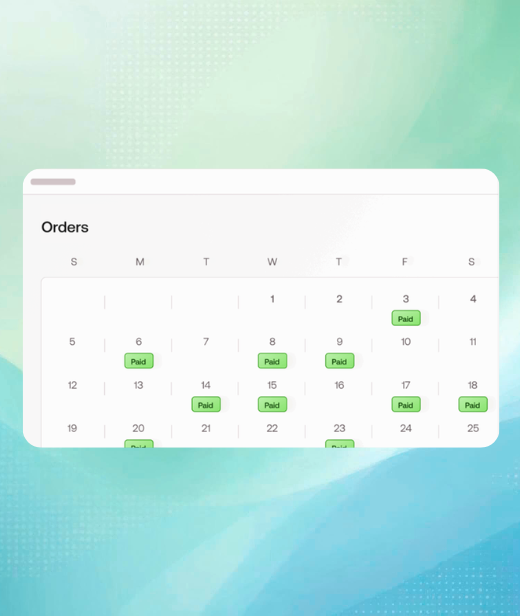

Stop Losing Revenue to Deductions and Short-Pays

Deductions are not exceptions — they're part of retail economics. VendorConnect detects invoice-to-payment gaps, explains root causes, organizes supporting evidence, and helps teams resolve disputes faster.

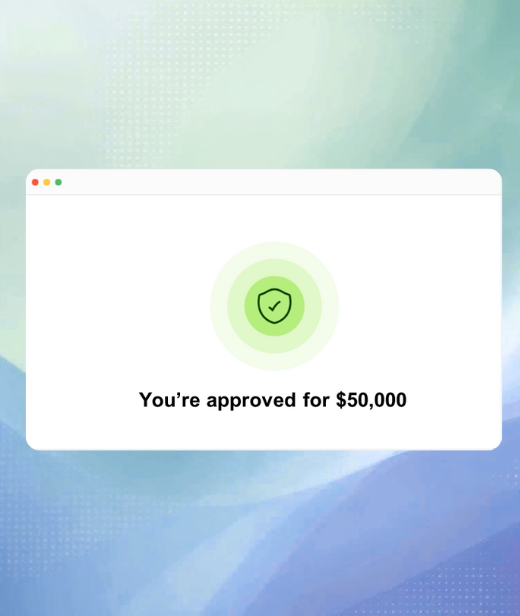

Financing, Powered by Verified Data

When receivables are clean and verified, VendorConnect enables access to financing through partners — without additional manual work.

Retail Execution Moves Fast. Financial Visibility Doesn’t

VendorConnect connects orders, execution, and payments so retail growth works financially from day one.

Traditional Reality

- Orders accepted without full financial validation

- Fees appear after delivery

- Teams investigate across emails and portals

- Disputes start too late

- Margin loss becomes normal

VendorConnect

- One financial source of truth from order to payment

- Every variance explained automatically

- Financial risk identified early

- Evidence organized per transaction

- Faster recovery and fewer repeat deductions

Retail decisions finally have financial context.

Your Retail Ecosystem — Always Connected

VendorConnect connects accounting systems, retailer portals, EDI data, and documents into a continuous financial intelligence layer.

How VendorConnect brings financial control to retail execution.

VendorConnect connects your retail data, explains financial impact, and helps teams act faster.

Connect Your Data

Sync accounting, retailer portals, and documents.

Understand Financial Impact

VendorConnect analyzes orders, invoices, and payments to identify risks and discrepancies automatically.

Act Faster

Approve orders confidently, resolve disputes quickly, and recover revenue earlier.

Retail Growth Shouldn't Mean Cash Uncertainty