Financial Infrastructure for B2B Commerce ✦

Stop Guessing. See What’s Blocking Your Cash.

VendorConnect shows when customer payments don’t match your invoices, explains why cash is missing, and tells your team what to do next — so you recover money faster.

Built for Brands and Distributors Selling into Retail

Consumer Brands

Recover deductions + stop silent short-pays

Retailers short-pay, deduct fees, and delay payments. VendorConnect flags every discrepancy and prioritizes the actions that recover cash fastest.

Distributors & Importers

Stop chasing payments across hundreds of accounts

High volume creates chaos: short-pays, missing PODs, pricing disputes. VendorConnect pinpoints what's blocking cash per customer and helps you resolve it faster.

Wholesalers

Know what will pay — and what won't

VendorConnect tracks payment behavior and exceptions so you can focus on the invoices at risk and prevent recurring short-pays.

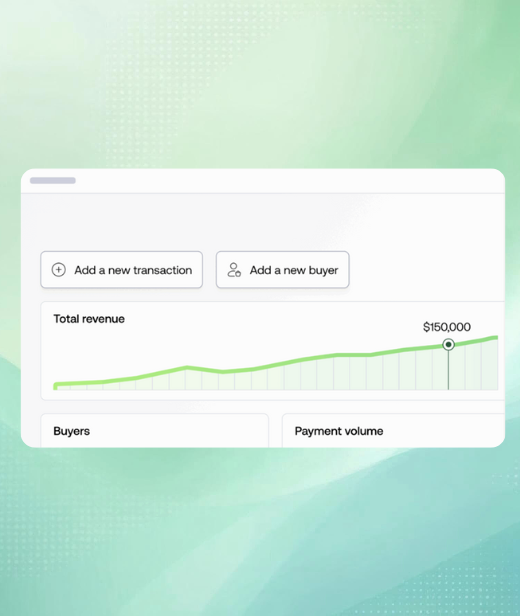

Grow your business, improve your cash flow, and scale your buyer base

Complete Cash Visibility — From Invoice to Cash Received

VendorConnect highlights cash blockers in real time: short-pays, deductions, missing documents, and delays — with the next best action for each invoice.

Stop Losing Money to Deductions and Short-Pays

We detect invoice-to-payment gaps, classify the reason, collect supporting documents, and help your team recover cash with less manual work.

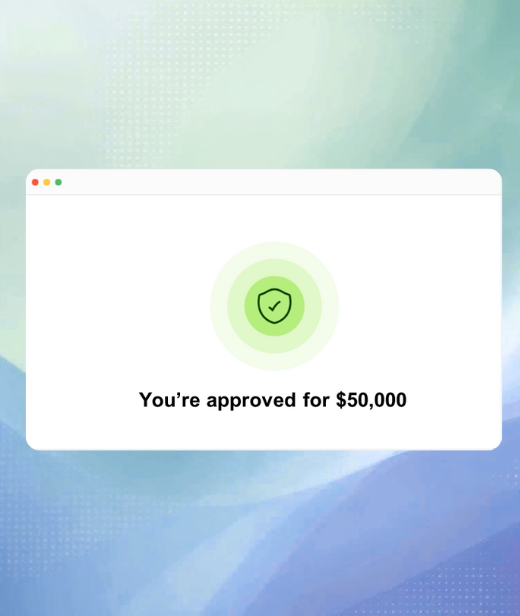

Fund Production When You Need It

Once receivables are clean and verified, you can access financing through partners — without starting from scratch each time.

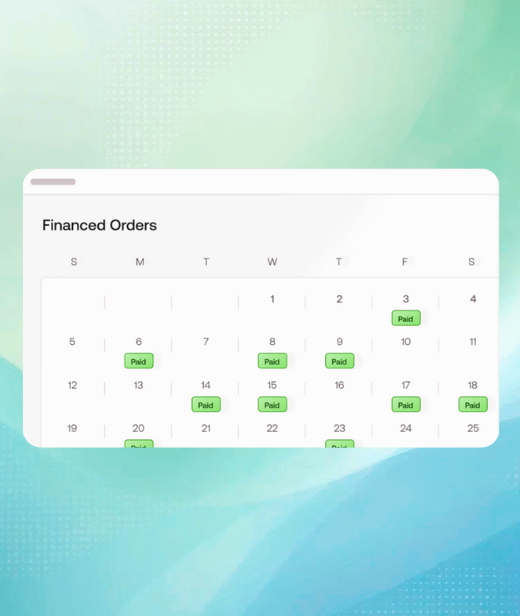

Get Paid Faster on Approved Invoices

Use verified invoice data to accelerate cash timing — when it’s worth it.

Why VendorConnect is different

One platform for your entire cash flow cycle — not just one-off financing deals

Traditional Approach

- Manual exception handling across portals and emails

- No single view of short-pays/deductions

- Weeks to find what's blocking cash

- Money lost because disputes start too late

VendorConnect

- One view of invoice to payment reality

- Cash blockers prioritized by $ impact

- Disputes and evidence organized per invoice

- Faster recovery + fewer repeats

We're with you from the moment you get a PO until final payment clears — and we help you keep more of it.

Your Supply Chain, Automatically Connected

We sync your systems so cash blockers are detected automatically — and every exception has the right evidence attached.

See what’s blocking your cash — and fix it faster.

Zero paperwork. Zero friction. Just results.

Connect Your Data

Link accounting + retailer portals to see invoice vs. cash received.

See What’s Blocking Cash

VendorConnect flags short-pays, deductions, missing documents, and delays.

Recover Cash Faster

Resolve disputes, prevent repeats, and optionally accelerate cash timing via partners.

We're here to power your growth, increase your sales, and securely scale your buyer base